Life Insurance in and around Charleston

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

You might think you don’t need to worry about life insurance while you are young. Actually, it’s the opposite! It’s much better to secure your life insurance in your 20s and 30s. That’s why your Charleston, SC, friends and neighbors of all ages already have State Farm life insurance!

Life goes on. State Farm can help cover it

What are you waiting for?

Why Charleston Chooses State Farm

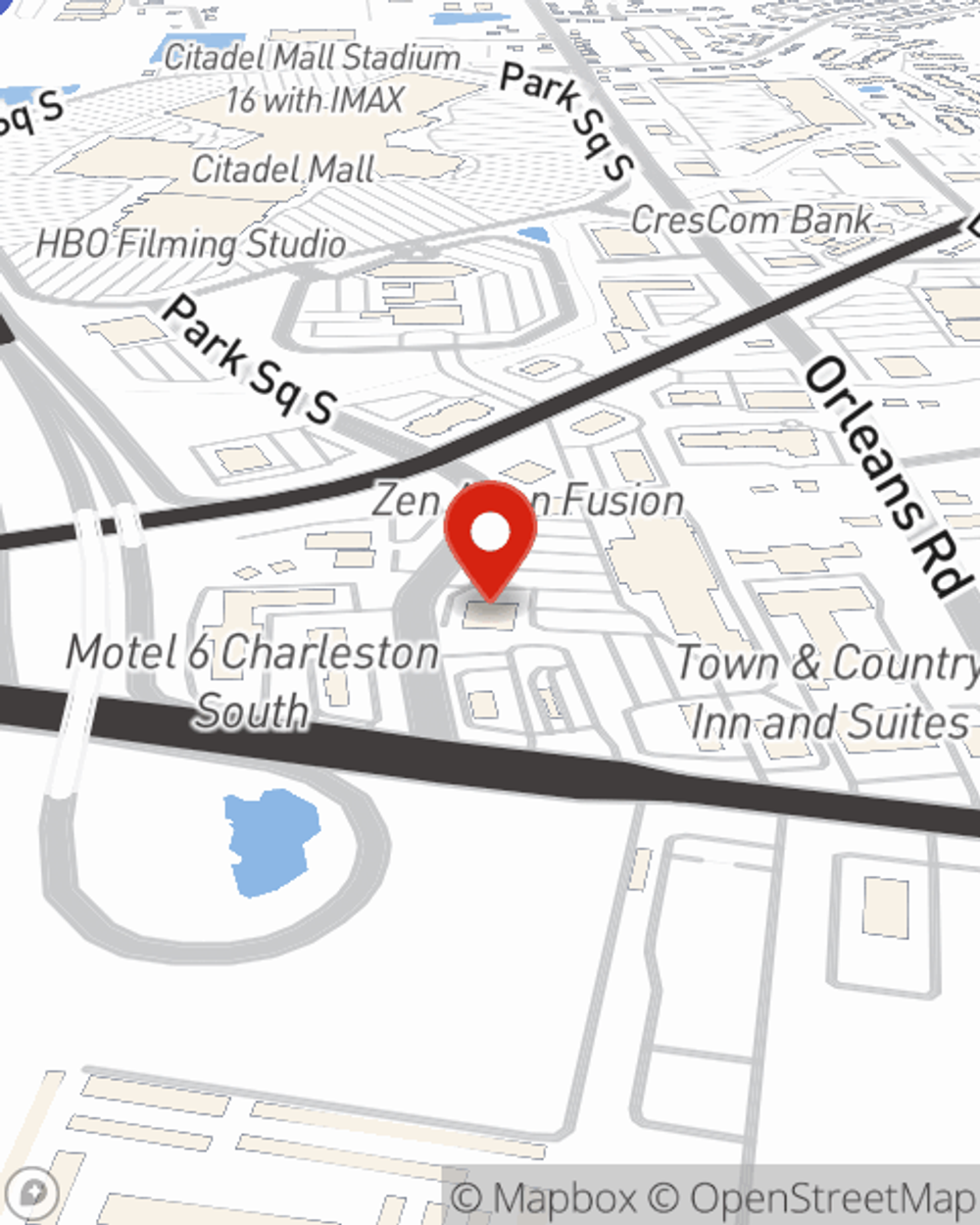

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific number of years level or flexible payments with coverage to last a lifetime or another coverage option, State Farm agent Andrew Komornik can help you with a policy that's right for you.

As a leading provider of life insurance in Charleston, SC, State Farm is committed to be there for you and your loved ones. Call State Farm agent Andrew Komornik today and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Andrew at (843) 277-9834 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Andrew Komornik

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.